Unless you’re working in the industry, the in’s and out’s of Income Protection insurance can often feel like a financial maze without an exit.

The minority of people get it and protect the #1 asset in their financial world, their income, but the problem is…a lot of people don’t, and it’s a ticking time bomb for their retirement plan.

As an adviser who’s spent years understanding income, life, trauma, disability and health insurance dynamics, I'm here to focus in on income protection insurance with five of the most powerful strategies that can help you save money on this cover, without compromising your financial security.

Strategy 1: Reduce Your Payment Period

The payment period is a critical factor in determining your income protection insurance premiums. This is the duration for which you'll receive benefits after making a claim. My research and conversations with thousands, reveal that strategically managing the payment period can lead to significant cost savings.

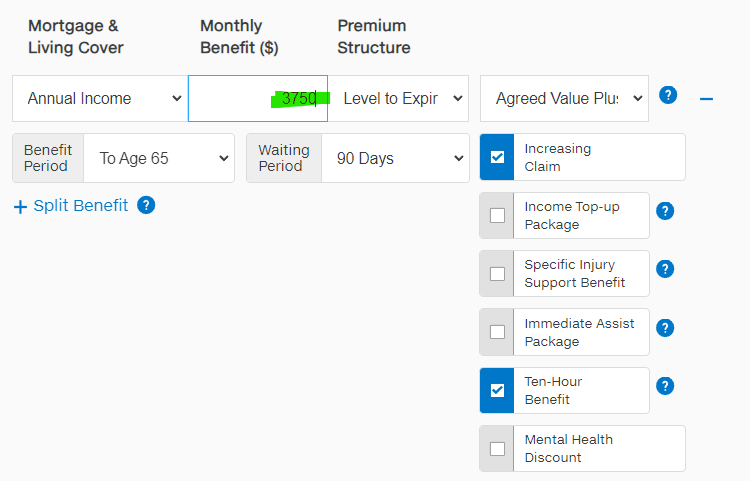

Typical policies offer payment periods ranging from 2 to 5 years, or even extending to age 65 or 70. By choosing a shorter payment period, you can dramatically reduce your monthly premiums. For instance, selecting a 5-year payment period instead of a ‘to ager 65’ period could result in substantial savings.

However, this strategy requires careful consideration of your financial situation and should be run through planning software to make sure it’s safe to do (see video here). You'll need to assess how long you realistically need income replacement. Consider your existing savings, potential alternative income sources, and long-term financial stability.

The key is to balance premium savings with your financial risk tolerance. While a shorter payment period can save money, ensure it doesn't leave you financially vulnerable in a critical moment.

Key points:

Payment periods range from 2 years or multiple years i.e. to age 65

Shorter periods reduce premiums

Assess your financial replacement needs

Balance savings with financial security

Consider long-term financial stability

Strategy 2: Choose a Longer Waiting Period

The waiting period – the time between becoming unable to work and receiving insurance benefits – directly impacts your premium costs. From my experience, this is one of the most effective ways to reduce your income protection insurance expenses.

Waiting periods typically range from 4 to 104 weeks. The longer you're willing to wait before receiving benefits, the lower your monthly premium. For example, extending your waiting period from 4 weeks to 13 weeks could reduce your premium by 20-30%.

This strategy requires a robust financial foundation. You'll need sufficient savings or alternative financial resources to support yourself during the waiting period. We recommend having 3-6 months of living expenses saved if you're considering a longer waiting period.

Carefully assess your emergency fund and financial stability before choosing a longer waiting period, and speak to a financial adviser first. While the premium savings can be attractive, you don't want to put yourself in a financially precarious position.

Key points:

Waiting periods range from 4 to 104 weeks

Longer periods significantly reduce premiums

Requires strong emergency savings

20-30% premium reduction possible

Balance savings with financial risk

Strategy 3: Adjust Your Coverage Amount

The amount of income you choose to protect directly influences your premium costs. Most income protection policies cover 50-75% of your gross income, making it unnecessary to insure 100% of your earnings.

Carefully evaluate your essential living expenses and existing financial resources (see video here (4th down)). If you have additional income sources, substantial savings, or a partner's income, you might not need full income replacement. Reducing your coverage to a more realistic amount can significantly lower your premiums.

Understanding different premium structures is crucial. Some policies offer stepped premiums (which increase with age) or level premiums (which remain consistent). Each has advantages and can impact your long-term insurance costs.

Review your policy annually and adjust coverage as your financial situation changes. Life events like marriage, having children, or changing jobs might necessitate coverage adjustments.

Key points:

Cover 50-75% of gross income

Assess actual income replacement needs

Understand premium structures

Review coverage regularly

Consider existing financial resources

Strategy 4: Bundle Insurance Policies

Insurance providers often offer significant discounts for bundling multiple policies. Combining income protection with other insurance types can lead to substantial savings and simplified insurance management.

Many insurers provide multi-policy discounts ranging from 8-13%. These discounts not only reduce your overall insurance costs but also streamline your insurance portfolio by consolidating policies with a single provider.

When bundling, maintain a critical eye on coverage quality. Don't compromise on essential protection just to save money.

Consider working with an insurance adviser who can help you find the most cost-effective bundle that provides comprehensive coverage across different insurance types.

Key points:

Bundle multiple insurance policies

Discounts of 8-13% possible

Simplify insurance management

Maintain coverage quality

Strategy 5: Understand Level vs. Stepped Premiums

The structure of your premiums can significantly impact your long-term insurance costs. Understanding the difference between level and stepped premiums is crucial for making a cost-effective choice (see video here).

Stepped premiums start lower but increase as you age. While initially more affordable, they can become substantially more expensive over time. Level premiums, conversely, remain consistent throughout the policy's life.

If you anticipate needing long-term coverage, level premiums might save you money in the long run. Although they start higher, they provide more predictable and potentially lower overall costs over many years.

Evaluate your long-term insurance needs, expected retirement age, and financial projections when choosing between these premium structures.

Key points:

Understand stepped vs. level premiums

Stepped premiums increase with age

Level premiums remain consistent

Consider long-term insurance needs

Project future financial situation

Conclusion

Saving on income protection insurance premiums is about strategic planning, understanding your personal risk profile, and making informed choices. By implementing these five strategies, you can potentially save significant money while maintaining essential financial protection.

FAQs

Q: How much can I save by implementing these strategies?

A: Potential savings range from 15-30% of your current premiums.

Q: Is it safe to reduce income protection coverage?

A: Only reduce coverage after carefully assessing your financial needs and risks. Speak to a financial adviser or book a strategy call with me today.

Q: How often should I review my income protection insurance?

A: Annually, or after significant life changes.

Q: Can I switch insurance providers to save money?

A: Yes, but have an adviser help you compare policies carefully to ensure equivalent coverage.

Q: Do all insurers offer these savings strategies?

A: Strategies vary, so seek professional help to compare multiple providers.

Hope this helps!

Chris George | Financial Adviser

Want more…?

👉This video explains how to WIN the financial game!📝

👉This video explains how a couple could accumulate an extra $1,200,000 in Kiwisaver over the next 25 years, without increasing their contributions or risk 📈

👉This video explains how to stop your income and life insurance premiums go up💡

👉Let's sit down and figure out how to map out a future you can look forward to…Click here or below to schedule a strategy call.

Note: Any information provided is for general and educational informational purposes only and is not personalised advice. Your circumstances are unique and there’s no templated road to a cushy retirement! For personalised advice, please book a Strategy Call.