So you want to retire early? Hell yeah, you do!

Imagine stepping away from the daily grind, flipping the corporate world the ultimate bird, and spending your days doing exactly what you want.

Early retirement doesn’t have to be just a dream! It can be your reality if you’re ready to commit. Let’s turn up the volume on what it takes.

Define Your Ideal Retirement

The very first thing you need to do is think of your “Why”.

I get asked so many times about tips or advice on becoming financially independent, or retiring early. The first thing I mention to them is that before they can even think about waving goodbye to the paycheck, they’ve got to envision what their ideal retirement will look like.

Do they want to travel the globe, start a passion project, start a band, write music, or maybe even open that dive bar in the tropics you’ve been dreaming of?

This is important. Knowing what you want is key because it shapes your entire financial strategy. Big dreams mean bigger budgets, so get clear and specific right from the start.

Build Your Expected Retirement Budget

Create a retirement budget, and keep it brutally realistic.

Picture retiring today—what would your monthly expenses look like? Consider housing, food, travel, insurance, and entertainment.

And let’s keep it real: For most, personal debt doesn’t belong in retirement. I highly suggest crushing that mortgage and killing your credit cards. This will set yourself up to be stress free without those financial burdens.

Assess Your Current Financial Status

This is kinda like tuning your coffee grinder before grinding the beans. You’ve gotta know where you stand right now.

What’s your current debt level? Your savings? Your Investment situation? How much do you earn? The clearer you see your present financial situation, the better you’ll be able to prepare your path to early retirement. It’s a long journey, know your starting point!

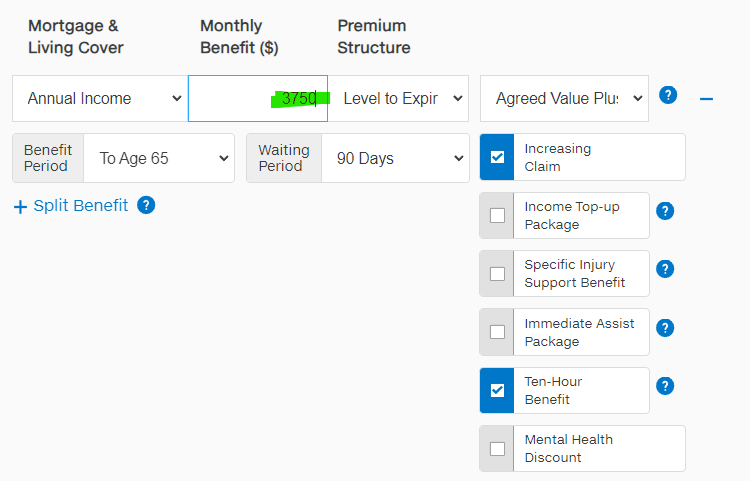

Set Up a Gap Account

We know you can’t just flick a switch, retire and start pulling money from your KiwiSaver. It doesn’t work like that.

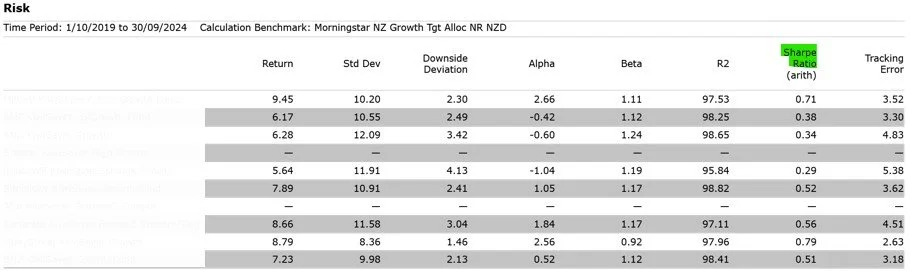

So to cover the gap years between your early retirement and KiwiSaver withdrawals plus government superannuation, what you can do is open an investment fund if you don’t already have one.

See, unlike KiwiSaver, an investment fund has no withdrawal restrictions. They also have no limits on contributions.

Their flexibility makes them a great option, IF you leave it to grow and don’t spend it in the meantime!

As far as what to actually invest in within this fund, it’s a wise idea to seek advice as there’s a myriad of options out there, and many of those options won’t suit your situation.

Crank It Up with Real Estate Investing

In addition to investing in the market, one thing that I did was also invest in Real Estate.

I do think that by investing in it, it can accelerate your path financial independence. By having rental properties, it can provide steady income that you can use during those gap years.

But here’s the truth: Debt equals risk, and nothing tanks retirement plans faster than heavy leverage gone wrong. Be very careful not to over leverage yourself when investing in real estate.

Obviously, paying cash for your investment properties would reduce your risk and boost your profits, but It’s totally fine to go slow and steady to use debt wisely, and ensure you analyse cash flow appropriately so that you can ensure you are covering the rental mortgage, paying maintenance and repairs, and building a cash reserve as well as enough to cover any vacancies.

If you’d like to learn more about investing in real estate check out my article over here.

And watch this video below to understand how to analyse whether it’s a good property for your needs.

Commit to Making Lifestyle Changes

If you are committed and really want early retirement, it’s time to get serious and brutal about your expenses.

This is where dreams meet reality, and some of those sacrifices become your best friend. You may need to slash your expenses ruthlessly. I’m talking about delaying some vacations, not dining out, cutting those subscriptions, and especially those impulsive buys! These have got to go. The few hundred bucks you save monthly by cutting back on groceries could mean thousands more in your retirement account over time.

Every little bit helps. Imagine saving just $15 each month from each of these categories like entertainment, clothing, and streaming services. This can add up to nearly $1,100 per year!

Push it to $30 per category, and you’re doubling your savings. Tightening your budget now means living your dreams sooner.

Do The Hustle

If you continue to be committed to the journey, and you want to pay off your debt sooner, in order to retire earlier. Or, if you want to keep some of these things in your budget, think about getting a side hustle or gig job.

There are tons of ways to make additional money to contribute to your retirement dream. Go make it happen!

Put The Pieces All Together

Here’s where it all comes together. Now that you’ve decreased your debt, and you are living lean, you have your investment fund growing, and maybe even bringing in more income with a side hustle, soon you’ll be maxing out those retirement savings, and overall contributing 10%, 20%, or even 30%+ of your income to your investments.

If you can continue to do this as long as you can to meet you goals, you’ll be ready to take that final bow and leave the corporate scene forever.

Play Smart When You Pull the Retirement Trigger

Okay, let’s say you’ve got your stuff together and you’re ready to step out of your 9 to 5, make sure you do it wisely.

Some things to keep in mind are:

Location: Where do you want to live? Do you want to move somewhere with lower taxes or living expenses? Determining where you’ll spend your later years is key to understanding your expenses at that point.

Income Streams: Will you completely stop working? Maybe you consult with your old gig, or maybe pick up a part-time gig or that side hustle? Decide how you’ll manage, access, and withdraw your different financial resources.

Healthcare: This was a lot easier than I thought it would be. When you retire early somewhere other than NZ, it means you are likely paying the bill for private insurance. It’s important to factor this expense into your budget.

Government Superannuation: Lastly, I’d consider treating this as gravy on the top. Plan like it’s not even there.

Check-In Regularly

I feel early retirement planning isn’t just a one-time gig; it’s an ongoing tour!

Check in with your investment professional or financial advisor. If you don’t have one, find one you trust and someone who gets you and your goals, and can help navigate the complexities along with your values.

Regular check-ins will keep your strategy sharp, make adjustments as needed, and ensure you’re on track. I do this with my “clients” annually to bi-annually, and keep an eye on where they’re going, what changes are happening and that we stay on track!

Hope this helps!

Chris George | Financial Adviser

👉Need an experienced, holistic Financial Adviser that has a proven approach to help you improve your financial situation and future? Book a call here.

Note: Any information provided is for general and educational informational purposes only and is not personalised advice. Your circumstances are unique and there’s no templated road to a cushy retirement! For personalised advice, please book a Strategy Call.