Many of us find choosing a Kiwisaver or Investment fund a complex and sometimes scary decision. And that's fair, it is your future that you're making decisions about after-all...and we’re not taught this stuff at school!

Understanding the basics of how to analyse risk-adjusted returns can simply simplify the process and swaps the 'Am I making the right call?' feeling to the certainty we all need. In this guide, I dive deep into the world of risk-adjusted returns, exploring how you, as a saver and investor, can evaluate fund performance across the New Zealand fund management landscape…way beyond simple return or fee comparisons.

You'll learn how to assess investments more intelligently, protect your portfolio and your future, and make more informed financial choices. And best of all, these principles can be taken to all investments…i.e. property, crypto, even business. It might just change how you think about money.

So, what are Risk-Adjusted Returns and why do they matter?

Risk-adjusted returns are a sophisticated approach to evaluating Kiwisaver fund and investment performance that goes beyond simple percentage gains.

Unlike traditional return measurements, this method considers the amount of risk taken to achieve those returns.

Imagine two Kiwisaver funds: one that generates 10% returns with minimal volatility and another that also generates 10% but with extreme price fluctuations.

Adjusting the returns for the risk helps an investor understand which of the two is truly more valuable.

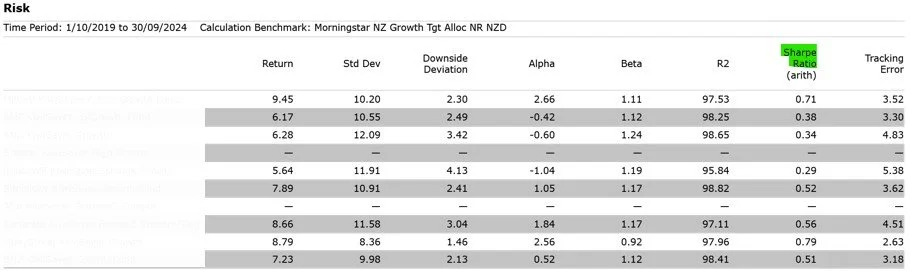

We source a quarterly risk versus return chart that compares the Kiwisaver and Investment fund performance across New Zealand. As part of our analysis for clients Kiwisaver and fund management, we use these metrics. An example of how they can be used is below:

Key Components of Risk-Adjusted Returns

1. Understanding Kiwisaver Fund Risk Metrics

Risk-adjusted returns are fundamentally about balancing potential rewards with potential dangers. An adviser uses sophisticated metrics to evaluate how much return a fund is generating relative to the risk it is assuming.

These metrics provide a more nuanced view of the investments performance, allowing for more intelligent decision-making.

The primary goal of a risk-adjusted analysis is to normalise returns across different asset or investment opportunities. By considering factors like volatility, standard deviation, and potential downside, you can make a much more informed choices about where to allocate your capital.

Professional investors rely on multiple risk-adjusted metrics to create a comprehensive view of investment potential. These metrics help them compare investments that might appear similar on the surface but have dramatically different risk profiles.

Understanding these metrics requires a combination of mathematical knowledge and financial insight. If you use Kiwisaver as a retirement vehicle, I’d recommend looking beyond surface-level returns and digging deeper into the underlying risk characteristics of your investment.

Key points:

Risk-adjusted returns provide a holistic view of investment performance

Metrics help normalise returns across different investment types

Professional investors use multiple risk assessment tools

Mathematical and financial knowledge is crucial for accurate analysis

Comparing risk-adjusted returns reveals hidden investment insights

2. Calculating Risk-Adjusted Performance Measures

Calculating risk-adjusted returns involves several sophisticated mathematical approaches.

The Sharpe ratio is perhaps the most well-known method, which compares an fund's excess return to its standard deviation. This helps you understand how much additional return you're receiving for each unit of risk taken.

We source this measure for our clients when they’re choosing a Kiwisaver fund(s) and/or different types of investments.

Along with other metrics, we look at the Sharpe Ratio comparison across the KiwiSaver funds to understand the ‘apples versus apples’ risk are taking for your savings. (I’ve blanked out the providers as these measures change over time.)

Another critical measure is the Treynor ratio, which evaluates returns relative to systematic market risk. Unlike the Sharpe ratio, it uses beta instead of standard deviation, providing insights into how a Kiwisaver or investment fund performs compared to the broader market.

The Jensen alpha is a more advanced metric that measures an investment's performance against a expected return based on the capital asset pricing model. It helps investors identify investments that are outperforming or underperforming relative to their expected risk level.

Modern portfolio theory has revolutionised how investors think about risk and return. By understanding these calculation methods, investors can make more sophisticated investment decisions that go beyond simple return percentages (see video here).

Key points:

Sharpe ratio compares excess returns to standard deviation

Treynor ratio evaluates returns relative to market risk

Jensen alpha measures performance against expected returns

Modern portfolio theory provides advanced risk assessment techniques

Multiple metrics offer a comprehensive investment evaluation

3. Practical Applications in Kiwisaver and Investment Fund Strategy

Risk-adjusted returns are not just theoretical concepts but practical tools for real-world Kiwisaver and Investment fund management.

Institutional investors, hedge funds, and sophisticated individual investors (you) can use these metrics to build more robust portfolios that can weather market volatility.

By prioritising risk-adjusted returns for your Kiwisaver, you can create a more balanced and resilient investment strategy. This approach helps mitigate potential losses while still pursuing meaningful growth opportunities.

Diversification becomes more strategic when viewed through the lens of risk-adjusted returns. You can identify a Kiwisaver or investment fund that provides complementary risk profiles (they aren’t all equal), creating a retirement savings vehicle that is more stable and potentially more profitable over time.

Technology and advanced analytics have made risk-adjusted analysis more accessible than ever before, but you’ll need to team up with a trusted adviser to access them (schedule here).

“You now have powerful tools at your finger tips to evaluate and optimise your investment strategy with unprecedented precision.”

Key points:

Risk-adjusted returns guide practical investment decisions

Institutional investors rely on these sophisticated metrics, you can too

Diversification becomes more strategic and intentional

Advanced technology enables more precise risk assessment

Balanced portfolios can be created through careful analysis

4. Common Mistakes in Risk-Adjusted Return Analysis

Many investors make critical errors when attempting to analyse risk-adjusted returns. The most common mistake is relying too heavily on a single metric or misunderstanding the context of these calculations.

Overconfidence can lead investors to misinterpret risk-adjusted metrics, assuming past performance guarantees future results.

It's crucial to understand that these measures provide insights, not absolute predictions.

Another significant error is neglecting to consider the specific investment context. Risk-adjusted returns can vary dramatically across different asset classes, market conditions, and investment timeframes.

Investors must continuously educate themselves and remain adaptable. The financial landscape is constantly evolving, and risk assessment techniques must keep pace with changing market dynamics.

Key points:

Avoid over-reliance on single risk metrics

Understand the limitations of risk-adjusted analysis

Context is crucial in interpreting performance measures

Continuous learning is essential for effective investing

Adaptability helps navigate changing market conditions

Conclusion

Risk-adjusted returns represent a powerful approach to understanding investment performance. By looking beyond simple percentage gains and considering the underlying risk characteristics, investors can make more informed and strategic financial decisions.

FAQs

Q: What is the most important risk-adjusted return metric?

A: The Sharpe ratio is widely considered the most comprehensive risk-adjusted return metric, but no single measure tells the complete story.

Q: How often should I calculate risk-adjusted returns?

A: Regular review is recommended, typically annually, depending on your investment strategy and portfolio complexity.

Q: Can individual Kiwisaver investors use risk-adjusted return analysis?

A: Absolutely! Our tools and investment platforms now offer risk-adjusted return calculations for individual investors.

Q: Do risk-adjusted returns work for all types of investments?

A: While most effective for traditional financial assets, the principles can be applied across various investment types with appropriate modifications.

Q: How significant are risk-adjusted returns compared to total returns?

A: Risk-adjusted returns provide crucial context that total returns alone cannot, offering a more nuanced view of investment performance.

Hope this helps!

Chris George | Financial Adviser

Want more…?

👉This video explains how to WIN the financial game!📝

👉This video explains how a couple could accumulate an extra $1,200,000 in Kiwisaver over the next 25 years, without increasing their contributions or risk 📈

👉This video explains how to stop your income and life insurance premiums go up💡

👉Let's sit down and figure out how to map out a future you can look forward to…Click here or below to schedule a strategy call.

Note: Any information provided is for general and educational informational purposes only and is not personalised advice. Your circumstances are unique and there’s no templated road to a cushy retirement! For personalised advice, please book a Strategy Call.